Instead of returning the `scheduleRefresh` command only after receiving an `update` message, do it while handling the `refresh` message. For this not to cause weird behavior, the refresh deadline should be shorter than the refresh interval.

moonmath

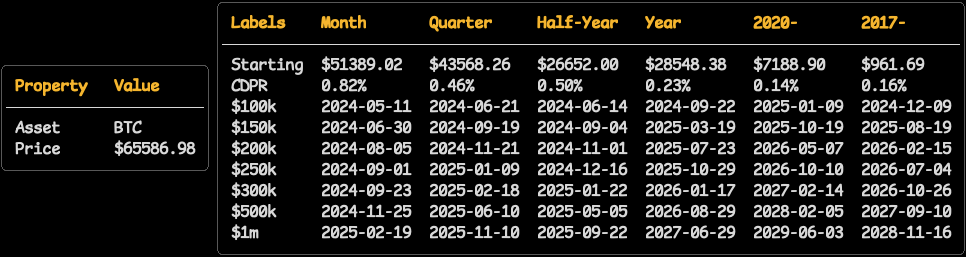

Bullshit Crypto Price Projections, Now in Your CLI!

This is a re-implementation of Moon Math that runs locally as a CLI program. It's written in Go using the Bubble Tea library, and uses Coindesk to source price data.

Installation

Go to the Releases page and download the archive for your operating system and architecture. (For the uninitiated, "Darwin" means macOS.)

Configuration

By default, the program will use Bitcoin along with various goals and bases of

comparison. With the --asset flag, another asset supported by Coindesk can be

chosen. These can even be chained, e.g. --asset BTC --asset ETH, to show

projections for multiple assets simultaneously.

The builtin default config only has special

goals a handful of the most popular assets. With the --config-file flag,

however, one can specify a YAML file that overrides these defaults and adds

goals for other assets.

Check out coindesk/assets.go for a full list of supported assets. Keep in mind these have not been exhaustively tested, and it's likely that many will fail with the default configuration settings.

"Theory"

Given a pair of quotes taken at the start and end of some period,

(t_s, p_s), (t_e, p_e)

we can derive the total gain for that period, and its length in days.

g = p_e / p_s

d = t_e - t_s

Combining these, we can calculate the compounding daily periodic rate (CDPR).

r = g^{1/d}

We can use this rate to project the price p_f at some x days in the

future.

p_f = p_e r^x

If we instead make p_f a target price, we can solve this equation for x,

telling us how many days it will take to reach that target.

x = {{log(p_f) - log(p_e)} \over log(r)}

Future Improvements

- Add more default configurations for various assets.

- Allow projection by date, e.g. use the CDPR to calculate what the price would be on a particular date.

- Log errors to a file.